Microsoft announced the availability of the Microsoft Cloud for Financial Services at Microsoft Ignite on November 3, 2021. The cloud service will offer Microsoft productivity tools bundled with financial services-specific components and regulatory approval.

The Microsoft Cloud for Financial Services, as it is known, is one of Microsoft’s bundles that build industry-specific requirements on top of its suite of cloud-based productivity tools, including Microsoft 365, Teams, Azure, its CRM and ERP offering Dynamics 365. It is designed for industry regulatory requirements and control frameworks, including multi-layered security, compliance, and trust commitments built-in. On top of this foundation, Microsoft has built new capabilities, data connectors, analytics, and artificial intelligence (AI) tailored to the financial services industry.

The offering will also be augmented by an unrivalled global ecosystem of trusted partners, including leading ISVs and System Integrators, to ensure that organizations in all regions have comprehensive solutions and interoperability with their existing systems.

The service offerings for financial services are designed focusing on three key digital experience areas:

- Obtaining in-depth customer insights to ensure that interactions and experiences are relevant.

- Identifying the most effective ways to engage clients and meeting them where they are across channels.

- Empowering employees with modern tools to collaborate with peers and across customers.

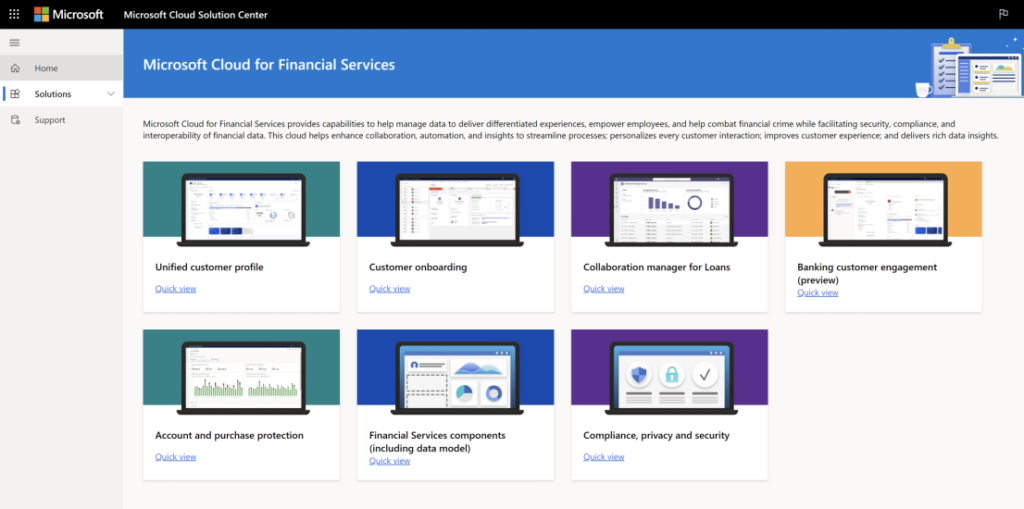

How does it look like?

To provide a high-level overview of the Microsoft Cloud for Financial Services.

360-degree customer insights – This service brings together financial, behavioral, and demographic data to tailor customer experiences with a 360-degree view of the banking customer and suggested next actions.

With the 360-degree view of customers, relationship managers can tailor customer journeys and make experiences relevant.

Customer Churn Modelling – The churn model powered by AI is specifically tailored for retail banking customers and utilizes rich data sets across Financial Holdings (Accounts, Credit Lines, Loans, Long-term Savings), Financial Instruments (Cards, debits, standing orders, overdrafts), and even “life moments” such as planned graduations, home purchases, and relocation. Customers can use their client data to develop predictive models using a simple step-by-step wizard, which provides a model performance grade (A, B, or C) that represents the prediction’s accuracy.

Collaboration Manager – Designed for lending processes. Collaboration Manager for loans utilizes Microsoft Teams to enable automation and collaboration across front and back office. This helps improve business-to-consumer communications to accelerate lending processes, minimize errors, and enhance customer experience.

Customer onboarding – This process provides customers with easy access loan apps and self-service tools, helping streamline the loan process to enhance customer experience and loyalty while increasing employee productivity. This automation is built on top of the Power Platform, for loan application tracking and can be extended with data from existing tools, using pre-built connectors, and/or customized using low-code development tools.

Banking customer engagement dashboard – to help personalize customer interaction with financial understanding and to engage customers on their preferred channel, while intelligently managing their journeys across channels.

Orchestrate your Deployments

The Industry Cloud contains a composable set of use case scenarios to meet you where you’re at. There is a Deployment Orchestrator exclusively developed for the Microsoft Cloud, that allows easy consumption and updates of these use case scenarios across customer environments in regions around the world.

Watch this video from Microsoft Ignite for more Info:

Here is a guide on How to deploy and use Microsoft Cloud for Financial Services in your organization, review the documentation.